Confronted with unsteady economic conditions, advancements in technology, and increased regulations, the banking industry has undergone a large transformation over the past few years, as have its customers’ needs and preferences. What was once a process requiring customers to visit their local bank and speak with bank tellers to address their various needs (deposit checks, take out money, set up accounts, transfer money, get advice, etc.), banking can now be done virtually without any human interaction thanks to the various online banking and virtual wallet apps that have been made available to consumers. And with the ability to self-service their own needs via computers, tablets, and mobile phones, do customers still value/take into consideration a financial institution’s customer service when deciding whether or not to bank with them?

Short answer, YES

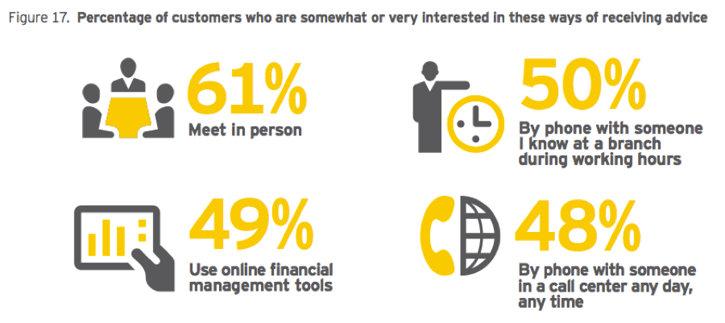

According to Ernst & Young’s 2014 Global Consumer Banking Survey, “Winning through Customer Experience”, which includes responses from more than 32,000 retail banking customers across 43 countries, 61% of consumers are still interested in receiving financial advice in person, 50% by phone with someone they know at a branch during working hours, and 48% by phone with someone in a call center—all of which are greater than or comparable to the 49% who are interested in doing so using online financial management tools.

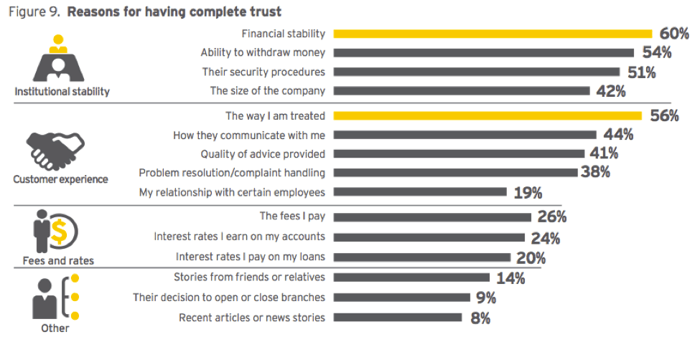

Moreover, the survey also revealed that customers value “the way I am treated” as the second most important reason for trusting their banking provider, trailing only the “financial stability” of their bank, and ahead of fees & rates, size of the company, security procedures, and the ability to withdraw money.

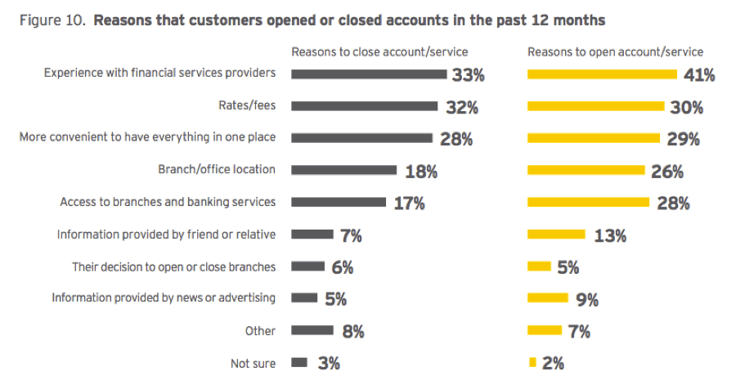

And consumers aren’t as forgiving as they once were—in fact, the global switching economy is up 29% since 2010, highlighting the harsh reality of customer turnover in today’s business environment. As it relates to the banking industry, there seems to be a large opportunity cost for those who fail to deliver high quality support to their clients—more than half of all customers either opened or closed an account in 2013, and 40% planned to do so in 2014, with “experience with financial services providers” as the driving force behind both.

The Conclusion

Despite recent economic turmoil, technological innovations, and growing rates/fees, customer experience via an agent/teller led interaction continues to be the driving force behind consumers’ willingness/unwillingness to conduct business with banks. And as financial services companies continue to invest time and resources into virtual forms of banking and self-service, such a focus should never come at the expense of delivering high-quality live assistance in-person, on the phone, and in the contact center, as these avenues have shown to differentiate banks amongst the competition. By continuing their focus on acquiring and retaining talented employees, improving training and coaching, and empowering agents to efficiently resolve customer needs through the adoption of innovative technologies (CRM, WFM, WMO, cloud call center software, interactive voice response (IVR), skills-based routing, etc.), banks can better attract new customers and retain/expand existing accounts to improve their overall success.